19th December 2014 by Jason Vincent

HMRC's Patent Box – Incentivising Innovation-led companies in the UK

The UK’s Patent Box scheme is an interesting one that I have heard come up in conversation increasingly more over the past year. At its core, it is designed to reduce the Corporation Tax liability of companies commercialising products for which they have developed Intellectual Property – more specifically patents. In such cases, the effective rate of Corporation Tax on profits of eligible revenue is reduced to 10% (subject to phasing in caveats).

The scheme went in to effect in 2013, and it seems to have been designed to complement the existing Research & Development tax credits system, that also impacts Corporation Tax directly. Whereas the existing R&D tax credits scheme provides a tangible incentive for companies to undertake their R&D activities in the UK, the Patent Box initiative aims to provide an incentive for companies to commercialise their products, and retain the respective Intellectual Property Rights in the UK (you can read more about it at https://www.gov.uk/corporation-tax-the-patent-box along with details about how the relief can be calculated).

As with most tax changes, there is a phasing in period that is scheduled to end in 2017, prior to which only a proportion of qualifying revenue can have the reduced rate applied. However, it is without a doubt an exciting scheme that can have a significant impact on businesses in the UK. When you combine this with the R&D Tax Credits system already in place, the UK government is clearly creating a very fertile breeding ground for technology companies, looking for a sustainable and accommodating place to grow.

There are, however, a number of areas worth looking at more closely. One of the biggest challenges that I can see in the technology space is the indirect focus on manufacturing and engineering businesses, rather than those developing software. Even when you’re considering R&D Tax Credits, the criteria is (generally speaking) centred on the activities seeking “the resolution of scientific or technological uncertainty”, and interestingly this is relatively closely related to the “European Patent Office’s requirement for a software invention to provide a technical contribution or a technical solution to a technical problem”[3].

We’ve been involved in patenting both software and physical (mechanical) processes in recent years, and the former can truly become a minefield, particularly in comparison to the latter. It’s no surprise therefore when you look over the Atlantic at the US struggling in its fight against companies hogging thousands of patents, and the legal battles that ensue. It’s a tricky field, and it seems that either no one has found a clean way to handle it yet, or it’s not simple enough (yet!) to be understood by most people.

Going back to the case with R&D Tax Credits, though these can (and are) claimed for software innovations, there is a fascinating balancing act that takes place by those that specialise in this area to frame the product and respective R&D correctly in order to qualify for the most amount of relief (or any at all, as the case may be).

So when we look at the Patent Box initiative, it’s interesting that they have focused specifically on revenue related to products that are protected by patents. Is the saving sufficient to lead to an increased interest in protecting software innovations with patents in the UK? It would be interesting to hear from legal firms specialising in Intellectual Property Rights, and see if there has indeed been an uptake in this area.

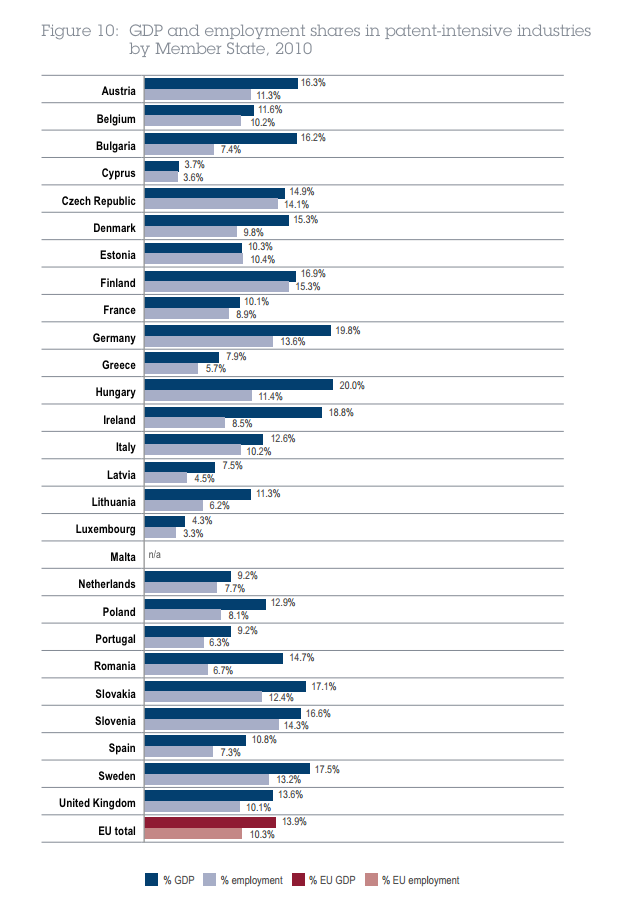

The expected cost for the UK economy (post the phasing in period) of launching this initiative has been forecast to lead to a £1.1 billion direct loss for HMRC. Running a few numbers backwards, that translates to approximately (emphasis on approximately) £200 billion in revenue in the UK, directly derived from Patented Innovations[4]. I’m not sure if that number strikes me as high or low. It translates to around 10.8% of GDP which sounds fairly reasonable. If you take in to account that the percentage of GDP in patent-intensive industries for the UK is 13.9%, then we might be on the right track, or at least not many miles off.

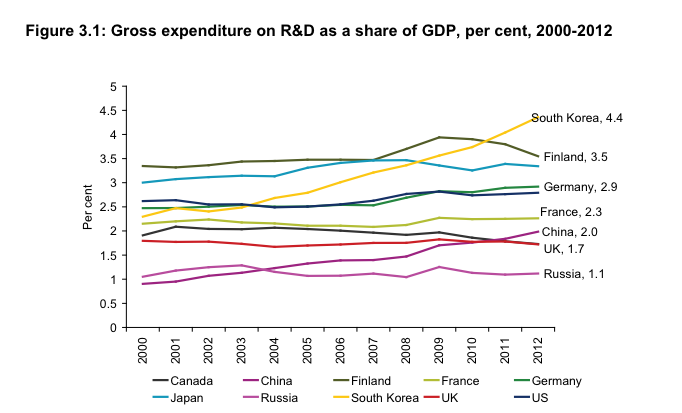

Of course, the reason this is even being introduced is because the UK continues to lag behind other countries in the EU (and certainly the world) when it comes to investment in Research & Development as a proportion of GDP. Unlike Finland that has successfully doubled this measure from 2% in the start of the 90’s to 4% in 2012, the UK has had a sad and steady run hovering around 1.8% during the same period of time[5]. It’s an interesting number, and it could reflect the lack of R&D undertaken in the UK itself, or perhaps the lack of R&D / Patent-intensive businesses that choose to be based in the UK in the first place.

Personally speaking, I for one would much rather see the UK take centre stage in innovation – be it digital technology, engineering or manufacturing – that power ahead as the ‘financial capital of the world’. It will be interesting to see how these initiatives impact the economy in the years to come.

References and additional reading:

[1]http://www.taylorwessing.com/synapse/ti_patentbox.html

[2]http://en.wikipedia.org/wiki/Patent_Box

[3]http://www.jakemp.com/uploads/files/topical-briefings/Patent_Box_for_the_Software_Industry_14.08.13.pdf

[4]Patent Box is essentially halving (or close enough) the Corporation Tax bill for qualifying revenue. If you start drawing a few assumptions, you could say that the other 10% or so would be equal to another £1.1 billion, making the full CT tax bill a total of £2.2billion. Working backwards, if we assume that most companies selling qualifying products might have a 10% NET Profit Margin, and that their qualifying revenue might be 60% of their overall revenue, then we’re essentially saying that their Gross Revenue would be in the region of £160b. Assuming 2 thirds of qualifying companies (by revenue) leverages this tax break, we have gross revenue of approximately £200b. We’re also assuming these companies are paying all their taxes domestically, and aren’t offsetting profits/losses from previous years etc. etc.

[5]https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/293635/bis-14-p188-innovation-report-2014-revised.pdf

[6]http://ec.europa.eu/internal_market/intellectual-property/docs/joint-report-epo-ohim-final-version_en.pdf